All Categories

Featured

Table of Contents

- – The Benefits of Choosing Term Life Insurance F...

- – How Does Simplified Term Life Insurance Keep Y...

- – What is What Is Level Term Life Insurance? Ex...

- – Why 20-year Level Term Life Insurance Is an E...

- – Key Features of Level Benefit Term Life Insu...

- – Is What Is Direct Term Life Insurance the Ri...

If George is diagnosed with a terminal disease throughout the initial plan term, he probably will not be eligible to restore the plan when it expires. Some policies use assured re-insurability (without proof of insurability), but such attributes come at a higher cost. There are several kinds of term life insurance policy.

Life insurance is more than just a policy; it’s a vital tool for protecting your loved ones and securing their financial future. Whether you’re looking for term life insurance to cover immediate needs or whole life insurance for lifelong security, the right policy offers peace of mind during life’s uncertainties. whole life insurance brokers. Affordable options include universal life insurance, which combines flexibility with investment opportunities, or final expense insurance, designed to cover funeral costs and related expenses

For homeowners, mortgage protection life insurance provides added security, ensuring your family can keep their home in case of unexpected events. Accidental death insurance is another valuable option, offering coverage tailored to specific circumstances. Many policies now come with living benefits, allowing policyholders to access funds in cases of critical illness or other emergencies, adding another layer of financial support.

Life insurance adapts to your goals, whether you’re planning for retirement, saving for college, or ensuring your business is protected with key person insurance. Speak with a licensed insurance agent today to discover flexible options that align with your family or business needs. Request a free quote now and take the first step toward a secure tomorrow.

Many term life insurance has a level premium, and it's the type we have actually been referring to in most of this short article.

Term life insurance policy is attractive to youths with children. Parents can obtain considerable coverage for an affordable, and if the insured passes away while the policy holds, the family members can count on the death advantage to change lost income. These plans are additionally well-suited for individuals with growing households.

The Benefits of Choosing Term Life Insurance For Couples

The right selection for you will certainly depend on your demands. Below are some points to take into consideration. Term life policies are ideal for people who want substantial insurance coverage at a low price. People who possess entire life insurance coverage pay extra in costs for much less coverage however have the safety and security of recognizing they are shielded forever.

The conversion cyclist ought to enable you to transform to any type of long-term plan the insurer provides without limitations. The primary features of the biker are preserving the original wellness rating of the term policy upon conversion (even if you later on have health issues or end up being uninsurable) and deciding when and just how much of the protection to convert.

Of program, total premiums will increase dramatically because whole life insurance policy is much more pricey than term life insurance policy. Clinical conditions that create during the term life period can not create premiums to be increased.

How Does Simplified Term Life Insurance Keep You Protected?

Term life insurance is a relatively low-cost way to offer a round figure to your dependents if something occurs to you. It can be a great alternative if you are young and healthy and balanced and sustain a household. Entire life insurance comes with considerably higher regular monthly costs. It is indicated to supply insurance coverage for as lengthy as you live.

Insurance firms established an optimum age restriction for term life insurance coverage plans. The costs additionally climbs with age, so an individual matured 60 or 70 will pay substantially more than somebody years more youthful.

Term life is somewhat comparable to automobile insurance. It's statistically not likely that you'll require it, and the premiums are cash down the tubes if you do not. However if the worst happens, your household will obtain the advantages (Increasing term life insurance).

What is What Is Level Term Life Insurance? Explained in Simple Terms?

For the many part, there are two types of life insurance policy strategies - either term or irreversible strategies or some mix of both. Life insurance companies use different kinds of term strategies and traditional life plans in addition to "passion sensitive" products which have come to be extra prevalent considering that the 1980's.

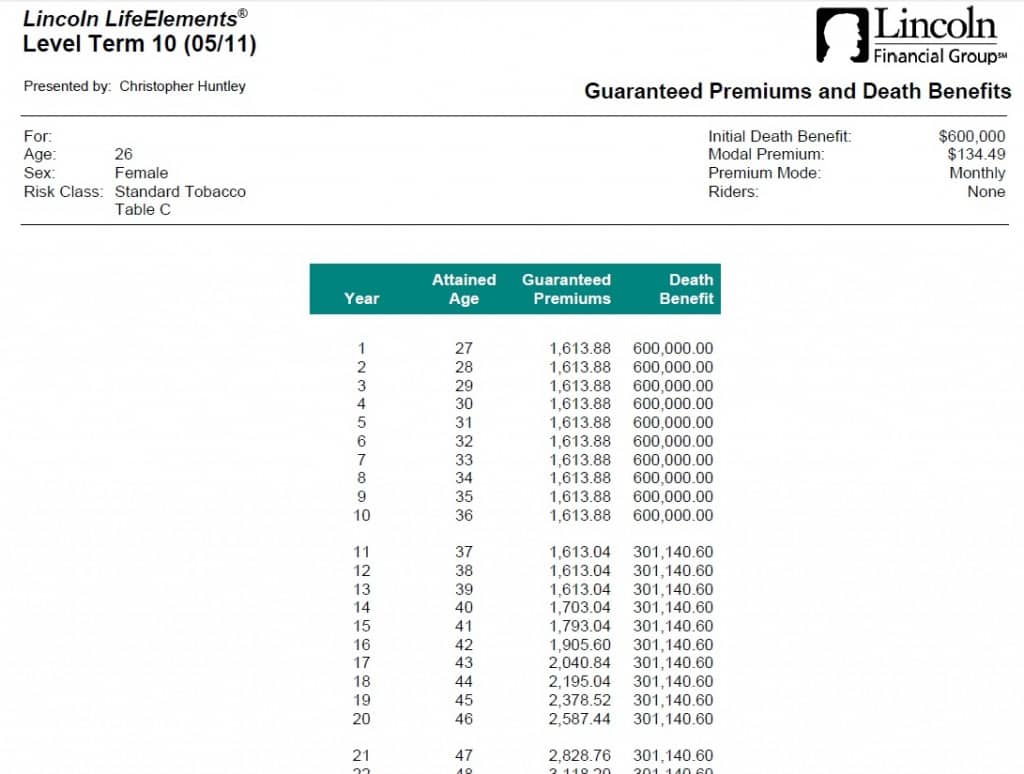

Term insurance coverage provides defense for a specific amount of time. This duration might be as brief as one year or supply insurance coverage for a particular variety of years such as 5, 10, 20 years or to a specified age such as 80 or sometimes approximately the earliest age in the life insurance mortality.

Why 20-year Level Term Life Insurance Is an Essential Choice?

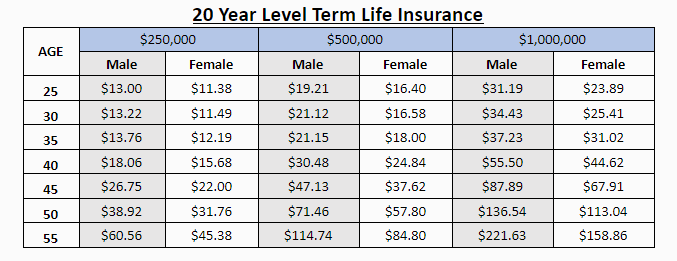

Presently term insurance policy prices are extremely affordable and amongst the least expensive traditionally experienced. It must be kept in mind that it is a widely held belief that term insurance coverage is the least costly pure life insurance policy protection readily available. One needs to examine the plan terms thoroughly to choose which term life alternatives appropriate to satisfy your certain conditions.

With each brand-new term the costs is boosted. The right to renew the policy without proof of insurability is an important advantage to you. Or else, the danger you take is that your wellness may wear away and you might be incapable to acquire a policy at the very same rates and even in any way, leaving you and your recipients without protection.

The length of the conversion period will certainly differ depending on the type of term plan bought. The costs price you pay on conversion is usually based on your "present attained age", which is your age on the conversion date.

Under a level term policy the face quantity of the policy stays the very same for the entire duration. Typically such plans are offered as mortgage protection with the amount of insurance coverage reducing as the equilibrium of the home loan lowers.

Traditionally, insurance firms have not can transform premiums after the plan is sold. Considering that such policies might proceed for several years, insurance providers need to use conventional mortality, interest and cost price estimates in the premium estimation. Adjustable premium insurance coverage, however, permits insurers to supply insurance policy at lower "present" premiums based upon less conservative presumptions with the right to change these costs in the future.

Key Features of Level Benefit Term Life Insurance Explained

While term insurance policy is made to provide defense for a defined period, permanent insurance is designed to give insurance coverage for your whole lifetime. To maintain the premium price level, the premium at the younger ages goes beyond the real price of security. This added premium builds a reserve (cash value) which helps spend for the policy in later years as the cost of security surges over the premium.

The insurance policy firm spends the excess costs bucks This type of plan, which is in some cases called money value life insurance, generates a financial savings component. Money worths are essential to a long-term life insurance plan.

Sometimes, there is no correlation in between the dimension of the cash money value and the premiums paid. It is the money worth of the plan that can be accessed while the insurance holder lives. The Commissioners 1980 Requirement Ordinary Mortality (CSO) is the existing table used in computing minimum nonforfeiture values and policy gets for common life insurance policy plans.

Is What Is Direct Term Life Insurance the Right Fit for You?

Lots of irreversible policies will certainly include arrangements, which specify these tax obligation requirements. There are 2 basic categories of permanent insurance, traditional and interest-sensitive, each with a variety of variants. On top of that, each category is usually available in either fixed-dollar or variable form. Typical entire life policies are based upon long-term price quotes of expenditure, rate of interest and mortality.

Table of Contents

- – The Benefits of Choosing Term Life Insurance F...

- – How Does Simplified Term Life Insurance Keep Y...

- – What is What Is Level Term Life Insurance? Ex...

- – Why 20-year Level Term Life Insurance Is an E...

- – Key Features of Level Benefit Term Life Insu...

- – Is What Is Direct Term Life Insurance the Ri...

Latest Posts

Low Cost Burial Insurance For Seniors

Advantages Of Funeral Insurance

Simplified Issue Final Expense Policy

More

Latest Posts

Low Cost Burial Insurance For Seniors

Advantages Of Funeral Insurance

Simplified Issue Final Expense Policy