All Categories

Featured

Table of Contents

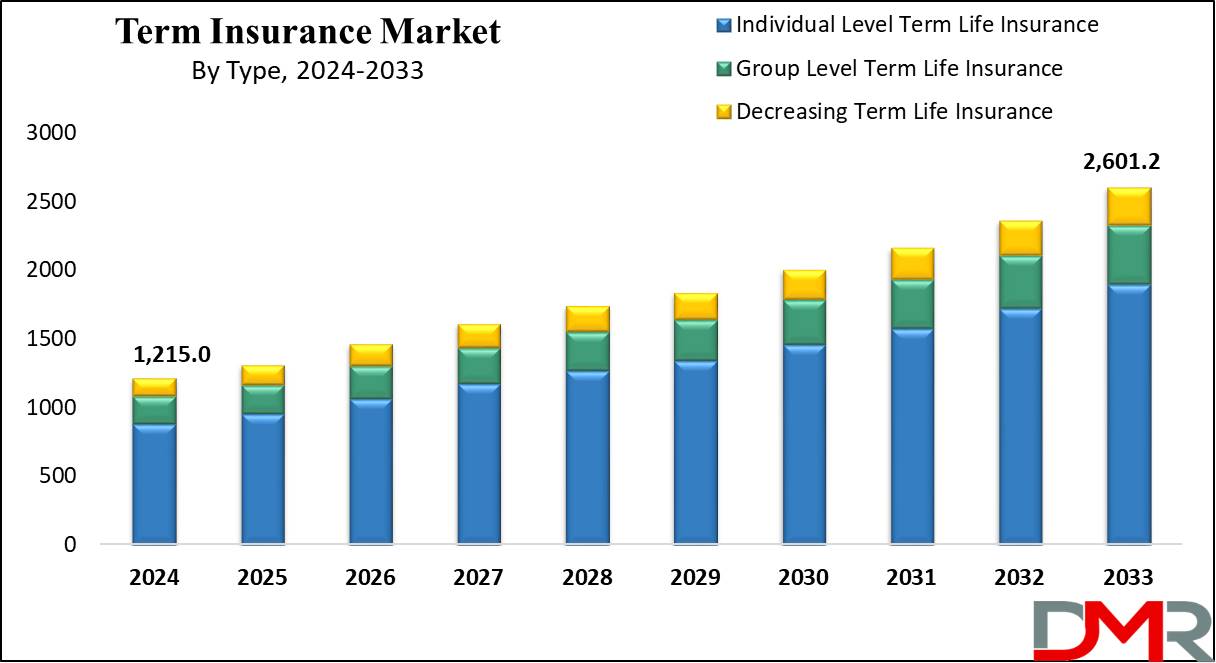

That commonly makes them a much more inexpensive option for life insurance policy protection. Some term policies may not maintain the costs and survivor benefit the exact same in time. Level term life insurance definition. You don't intend to wrongly think you're getting level term protection and after that have your survivor benefit modification in the future. Several individuals get life insurance protection to aid monetarily safeguard their liked ones in situation of their unanticipated fatality.

Or you may have the alternative to convert your existing term coverage into a long-term policy that lasts the remainder of your life. Numerous life insurance policy policies have prospective advantages and drawbacks, so it is very important to comprehend each before you decide to acquire a plan. There are a number of advantages of term life insurance policy, making it a preferred choice for coverage.

As long as you pay the premium, your beneficiaries will certainly receive the survivor benefit if you die while covered. That said, it is necessary to keep in mind that many policies are contestable for 2 years which implies coverage can be retracted on fatality, must a misrepresentation be located in the app. Plans that are not contestable often have actually a graded survivor benefit.

Everything You Need to Know About Decreasing Term Life Insurance

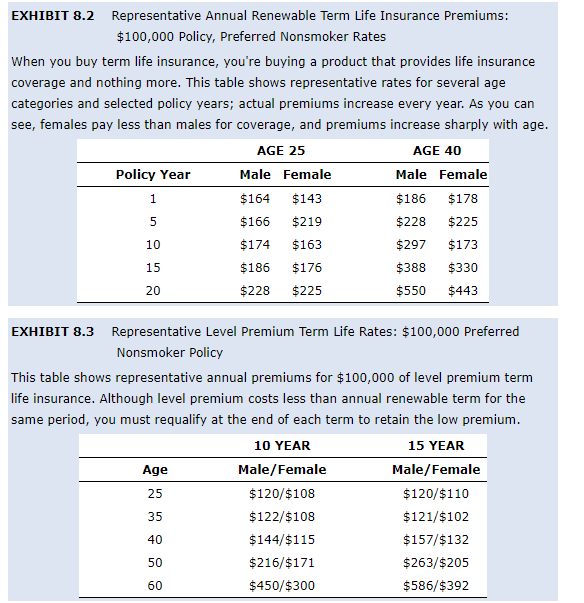

Costs are generally reduced than whole life policies. With a level term policy, you can choose your coverage quantity and the policy length. You're not locked into an agreement for the rest of your life. Throughout your policy, you never need to stress regarding the costs or survivor benefit amounts changing.

And you can not squander your plan throughout its term, so you will not receive any type of economic gain from your past coverage. Similar to various other kinds of life insurance policy, the price of a level term plan depends upon your age, protection requirements, work, way of life and wellness. Generally, you'll discover a lot more economical protection if you're younger, healthier and less high-risk to guarantee.

Because level term premiums remain the very same for the period of coverage, you'll know specifically how much you'll pay each time. Level term coverage likewise has some adaptability, allowing you to tailor your policy with additional functions.

What is 20-year Level Term Life Insurance? Learn the Basics?

You may have to satisfy certain conditions and certifications for your insurance firm to pass this rider. There also might be an age or time limitation on the insurance coverage.

The survivor benefit is usually smaller sized, and insurance coverage normally lasts up until your youngster transforms 18 or 25. This rider might be a much more cost-effective method to aid ensure your children are covered as cyclists can typically cover multiple dependents simultaneously. As soon as your youngster ages out of this coverage, it might be feasible to transform the biker right into a new plan.

When comparing term versus permanent life insurance policy, it is necessary to bear in mind there are a couple of different kinds. The most usual sort of long-term life insurance coverage is whole life insurance coverage, however it has some crucial differences compared to degree term coverage. Voluntary term life insurance. Below's a fundamental introduction of what to think about when comparing term vs.

Whole life insurance policy lasts permanently, while term coverage lasts for a details duration. The premiums for term life insurance policy are normally lower than entire life coverage. Nonetheless, with both, the costs remain the very same throughout of the plan. Entire life insurance policy has a money value component, where a section of the costs may expand tax-deferred for future demands.

One of the major functions of level term coverage is that your premiums and your fatality benefit don't change. You might have protection that begins with a fatality benefit of $10,000, which could cover a home loan, and then each year, the fatality benefit will reduce by a set quantity or portion.

Due to this, it's typically an extra budget-friendly type of level term insurance coverage., but it might not be sufficient life insurance policy for your demands.

What You Should Know About 20-year Level Term Life Insurance

After determining on a policy, complete the application. If you're accepted, authorize the documentation and pay your initial costs.

Lastly, consider scheduling time each year to review your policy. You might intend to upgrade your beneficiary details if you've had any substantial life adjustments, such as a marriage, birth or divorce. Life insurance policy can sometimes feel complex. Yet you do not need to go it alone. As you discover your options, take into consideration reviewing your requirements, wants and worries about a monetary expert.

No, level term life insurance policy doesn't have money value. Some life insurance policy policies have an investment function that enables you to develop cash money worth over time. A part of your premium payments is alloted and can gain interest gradually, which expands tax-deferred throughout the life of your coverage.

You have some alternatives if you still want some life insurance policy coverage. You can: If you're 65 and your protection has actually run out, for instance, you may desire to acquire a brand-new 10-year level term life insurance policy.

How Does Level Term Life Insurance Meaning Compare to Other Types?

You may have the ability to transform your term coverage into an entire life policy that will last for the remainder of your life. Lots of kinds of level term plans are convertible. That means, at the end of your coverage, you can transform some or every one of your policy to entire life insurance coverage.

A level costs term life insurance policy strategy allows you stick to your budget while you aid protect your household. Unlike some stepped price plans that boosts every year with your age, this kind of term plan offers rates that remain the same for the period you select, also as you get older or your wellness adjustments.

Navigating life insurance options can be overwhelming, especially with so many policies available. This is where working with an experienced insurance broker or agent makes all the difference. Unlike insurance agents tied to a single provider, brokers offer access to multiple life insurance options, helping you find the most suitable policy for your needs - accidental death insurance for families with agents. Whether it’s term life insurance for temporary coverage, whole life insurance for lifelong protection, or universal life for long-term growth, an insurance broker evaluates your unique goals and compares providers to secure the best coverage at competitive rates

For families, policies like final expense insurance, mortgage protection, and accidental death coverage offer tailored solutions to protect loved ones. Business owners can also benefit from key person insurance, ensuring continuity in the event of an unforeseen loss. With life insurance policies offering living benefits or instant coverage, brokers simplify the decision-making process and ensure your financial priorities are met.

By choosing the right insurance broker, you gain expert guidance, access to personalized recommendations, and the confidence of knowing your family or business is secure. Contact an insurance broker today to explore tailored life insurance options and secure peace of mind for the future.

Find out more about the Life Insurance coverage choices offered to you as an AICPA member (What is a level term life insurance policy). ___ Aon Insurance Providers is the trademark name for the broker agent and program management operations of Affinity Insurance policy Solutions, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Fondness Insurance Agency, Inc. (CA 0795465); in OK, AIS Fondness Insurance Providers Inc.; in CA, Aon Fondness Insurance Policy Providers, Inc .

Latest Posts

Low Cost Burial Insurance For Seniors

Advantages Of Funeral Insurance

Simplified Issue Final Expense Policy